iowa lottery tax calculator

This is equal to a percentage of Iowa taxes paid with rates ranging from. The Iowa Lottery does not withhold tax for prizes of 600 or less.

Mega Millions Tax Calculator Afterlotto

After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

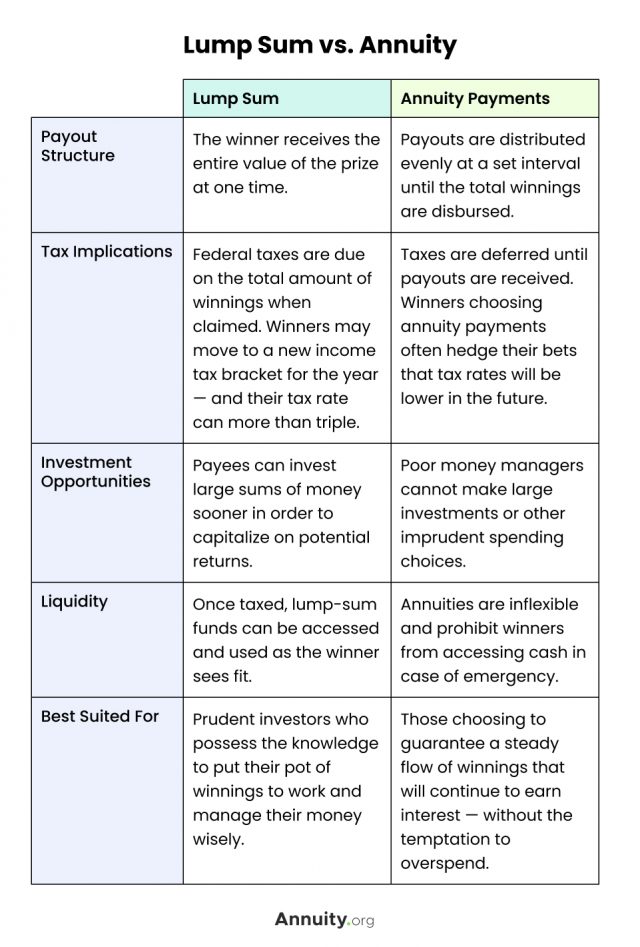

. To understand these complicated lottery tax calculations you need to get your hands on a lottery tax calculator and hire a financial advisor to get help over tax and. The Iowa tax that must be withheld is computed and. You may then be eligible for a refund or have to pay more.

23 You must be 21 years or older to play Video Lottery The 10 Best Mass Lottery Scratch Tickets This Month. Claiming Your Prize Game Info Jackpots InactiveExpired Tickets Lotto Game Do I have to pay taxes on my winnings. These lottery tools are here to help you make better decisions.

If a player wins more than 5000 an. Current Mega Millions Jackpot. This can range from 24 to 37 of your winnings.

Tuesday Oct 18 2022. Additional tax withheld dependent on the state. This also applies to winnings from a multi-state lottery if the tickets were purchased within the state of Iowa.

Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two. Lottery Winning Taxes in India. Although it sounds like the full lottery taxes applied to players in the.

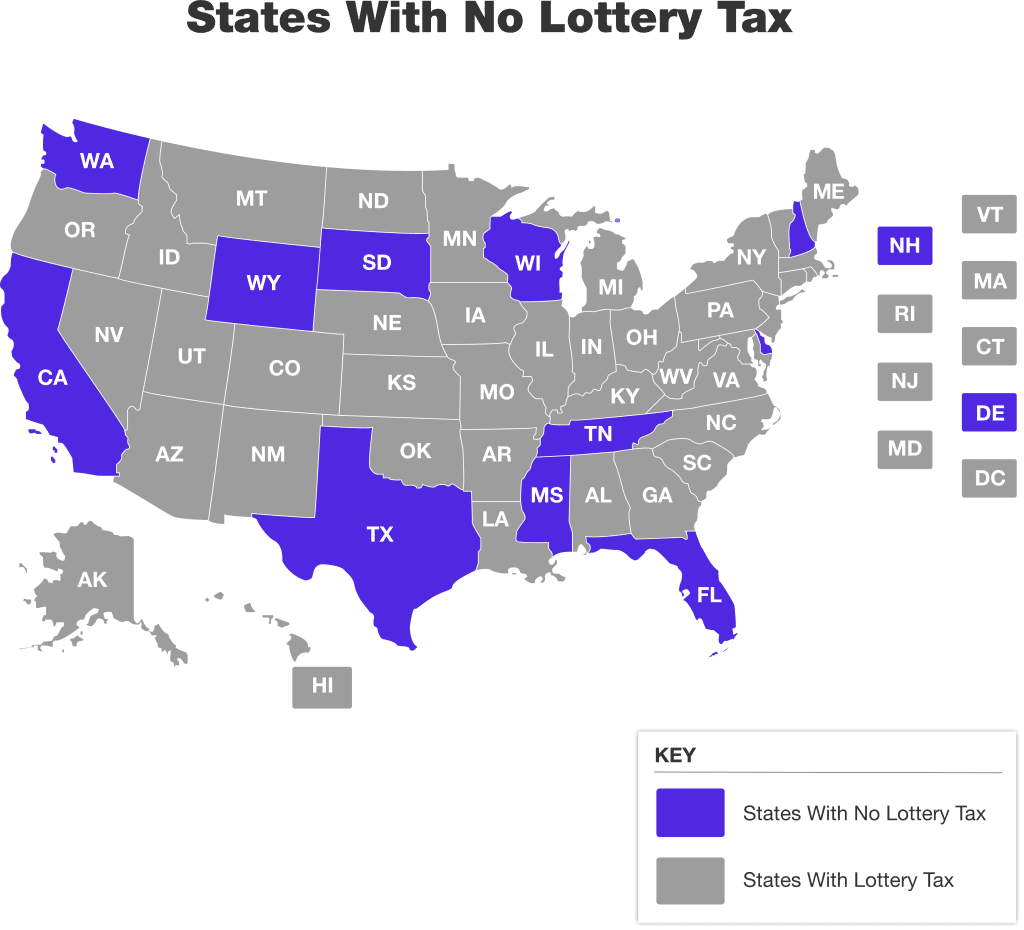

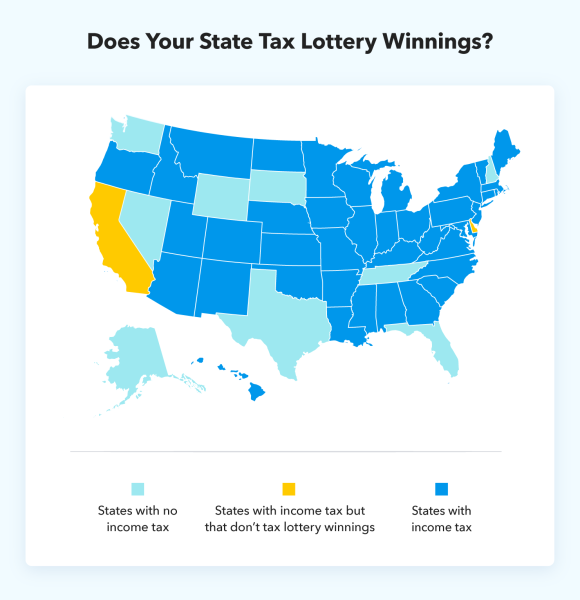

All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. This varies across states and can range from 0 to more than 8. Nonresidents are required to file an Iowa return if Iowa-source income.

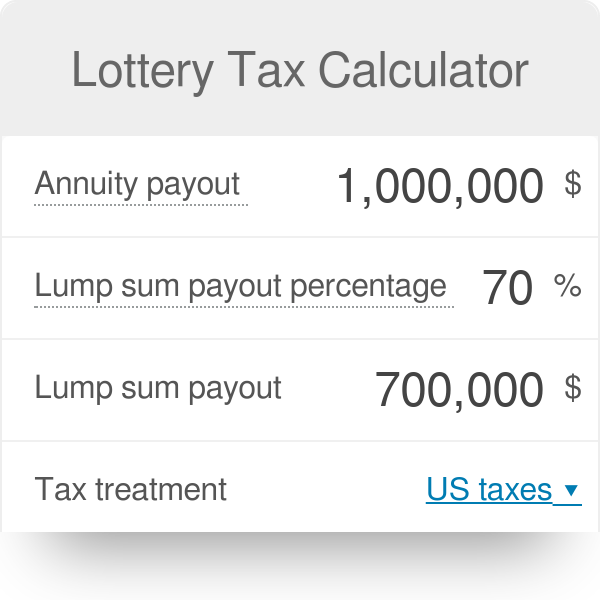

The calculator will display the taxes owed and the net jackpot what you take home after taxes. The 10 Best Mass Lottery. The Tax Calculator helps you to work out how much cash you will receive on your Lotto America prize once federal and state taxes have been deducted.

Imagine having to pay 28 in taxes on your precious lottery winnings. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. By law prizes of more than 600 will face a 5 percent state withholding tax.

For one thing you can use our odds calculator to find the lotteries with the best chances of winning. Calculate your lottery lump sum or. Iowa Lottery Tax Calculator.

The Iowa Lottery makes every effort to ensure the accuracy of the winning numbers prize payouts and other information posted on the Iowa Lottery website. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money.

Know How Much Taxes You Will Pay After Winning The Lottery

Lottery Calculator The Turbotax Blog

Powerball Jackpot Analysis Usa Mega

Are Lottery Winnings Taxed A Quick Guide Lottery Critic

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

Lottery Payout Options Annuity Vs Lump Sum

Iowa Lottery Revenue Up More Than 14 Wqad Com

Lottery Calculator The Turbotax Blog

Ialottery Blog Tell Me About The Taxes On The For Life Prizes In Lucky For Life

Lottery Tax Calculator What Percent Of Taxes Do You Pay If You Win The Lottery By Charles Weko Medium

Taxes On New York Lotto Winnings

Powerball Lottery Calculator Powerball

Free Gambling Winnings Tax Calculator All 50 Us States

Mega Millions Payout How Much Jackpot Would Be After Taxes Weareiowa Com